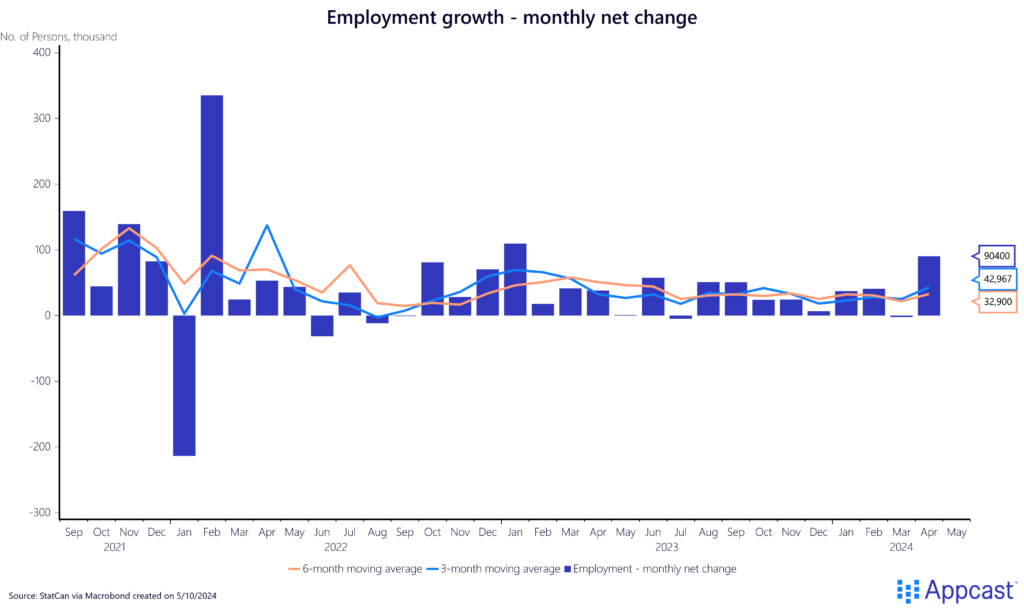

In March, Canada’s labor market lost 2,200 jobs, potentially showing signs of a labor market recession. This may have been a “head fake” (to use a basketball term) as last month job growth surged to 90,000 new jobs, a stunning reversal. This boosts the three-month average for job gains to above 40k, a sign that demand for hiring is still as robust as it was in 2023. Last month, we noted the labor market’s warning lights flickered yellow, signaling a possible slowdown. This month, the light hasn’t switched completely to green, but it remains far from red.

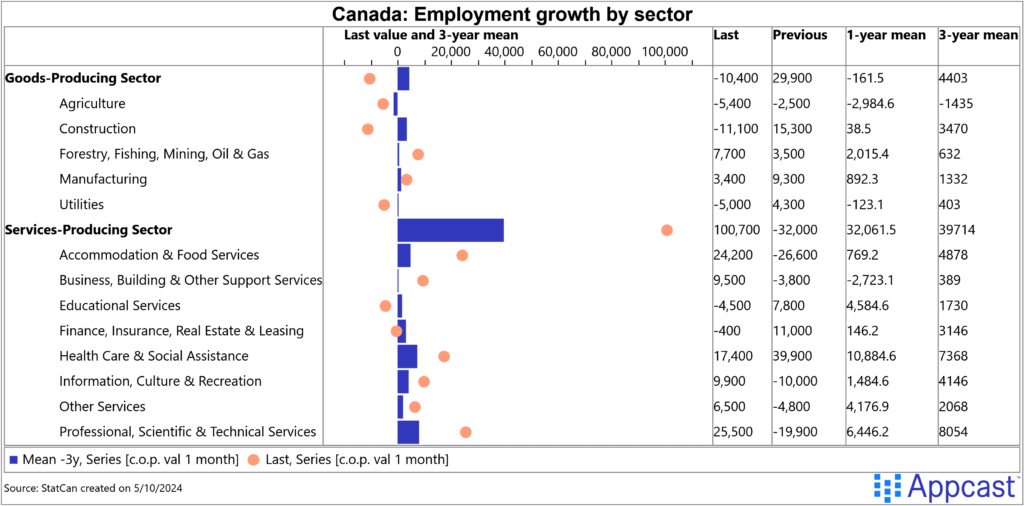

Sector Trends

Nearly all the job growth last month was concentrated in the services sector, led by professional and business services adding a surprising 25,500 new jobs, after losing nearly 20,000 the month before. Accommodation and food services (+24,000) continue its growth pattern as consumers continue their “revenge spending” coming out of the pandemic. Healthcare (+17,000) is still a powerhouse sector – the demand for registered nurses, home health aides, and physicians will persist throughout 2024.

The past several jobs’ reports have shown a growing divergence between the goods and services sector, which is continuing to happen as industries like construction (-11,000) and agriculture (-5,400) are facing weakness.

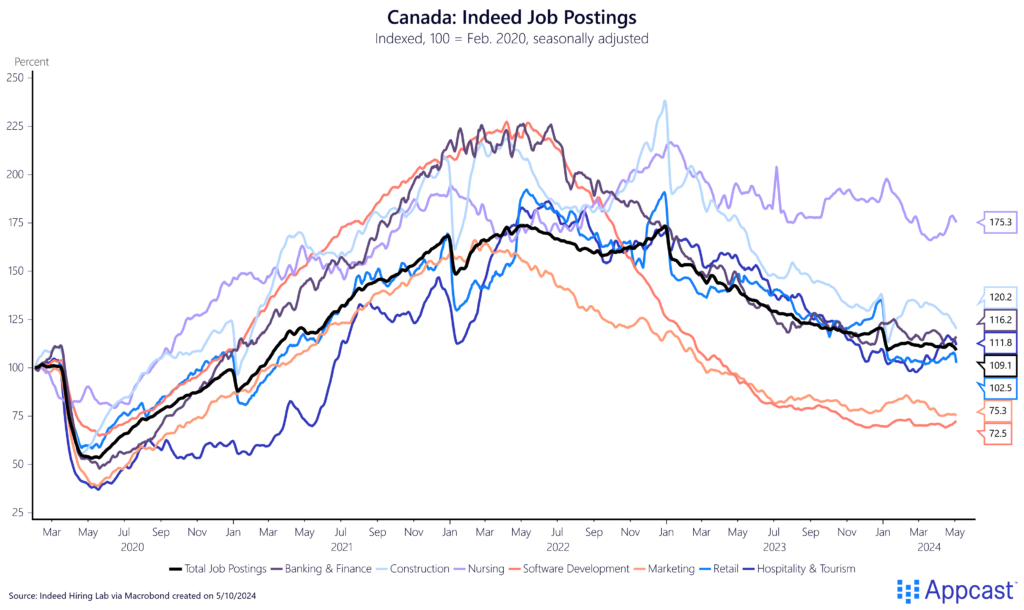

The divergence in growth between “standing up jobs” (like registered nurses) and “sitting down jobs” (like software developers) is also being reflected in Indeed data on job postings. For nursing jobs, they’ve increased a stunning 75% since the start of the pandemic! Construction and hospitality jobs are up 20% and 12% respectively. Those sitting-down jobs are falling significantly – software development and marketing roles are down nearly 30% since 2020.

Labor force trends

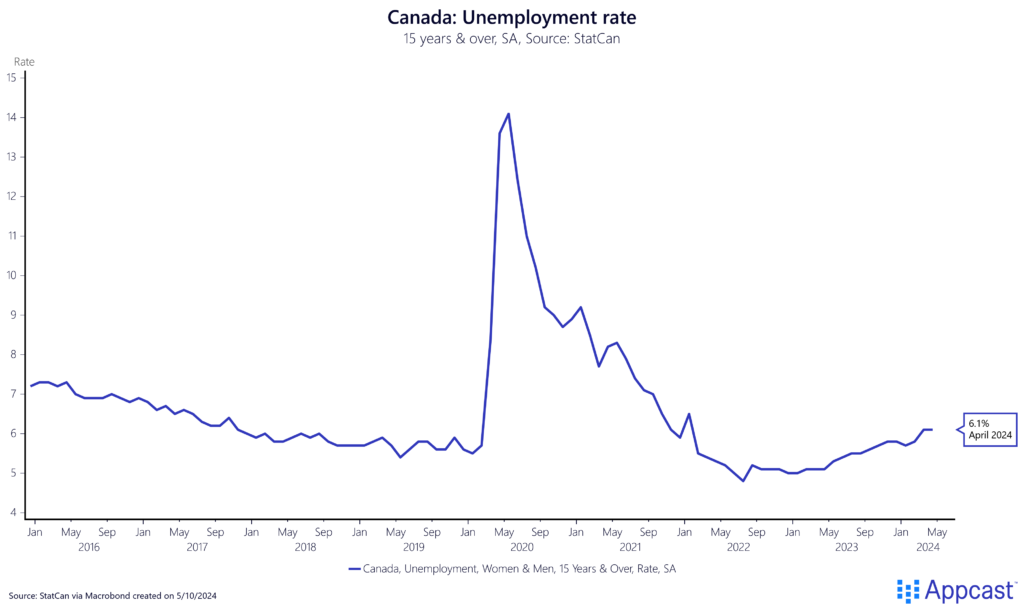

Last month we wrote about how Canada’s labor market recently triggered the “Sahm Rule,” which tracks the historical trend of the unemployment rate as a recession indicator. Thankfully, the overall unemployment rate stayed fixed last month at 6.1% after nearly two years of persistent increases. This modest decrease does not change the fact that since April 2023 the unemployment rate is up a whole percentage point, a worrisome trend driven by young Canadians.

For Canada’s youth, the unemployment rate has climbed to 12.8%, reaching its highest point since July 2016. A recent CBC article highlighted the impact of this increase on young professionals, many of whom are on the cusp of completing their undergraduate or graduate studies and preparing to enter the workforce. This uptick in unemployment signifies heightened competition for entry-level roles, which are becoming increasingly scarce, particularly in sectors such as technology and marketing.

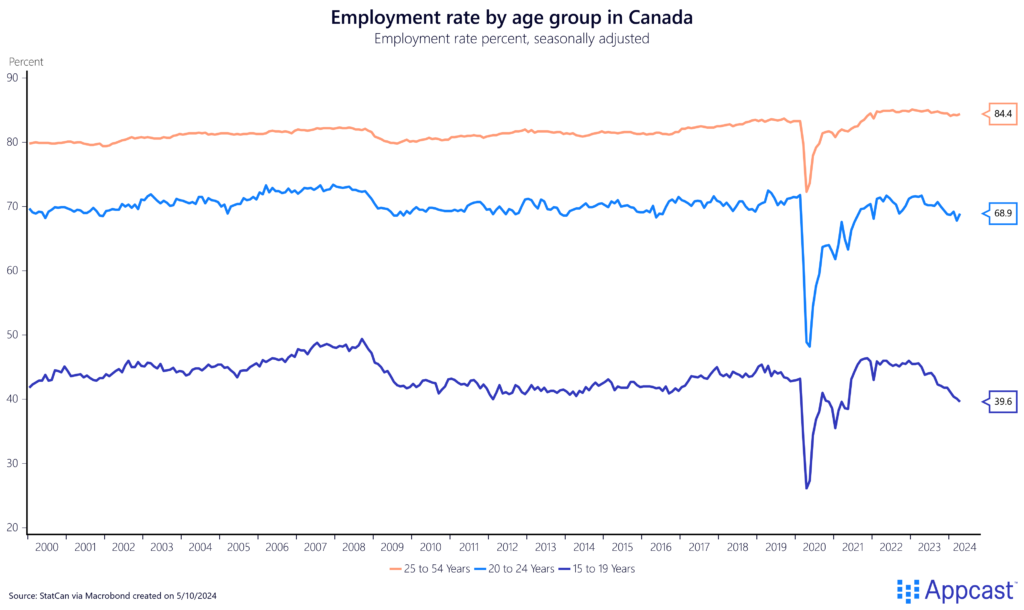

This slowdown in demand for young workers has been reflected in the employment rate as well (share of working age population employed) as the percentage of employed workers aged 15-19 has declined rapidly since 2021 – down from 46% to 39.6%. For the prime age workforce, the employment rate has steadily recovered coming out of the pandemic, increasing more than a percentage point since 2020.

What does this mean for recruiters?

Last month’s jobs numbers were a sigh of relief as March’s numbers potentially indicated a severe downturn in the labor market. While the stop light hasn’t shifted towards green or red quite yet, 90,000 new jobs is a promising sign that Canada’s labor market is more robust than previously thought. Recruiting for healthcare and service workers will continue to be competitive, while roles in tech and marketing are facing less pressure as younger Canadians are looking to break into the field as they finish their degrees in the spring.