The French economy is doing well

I recently discussed how the Eurozone is currently experiencing a reversal of fortunes. While the region suffered tremendously in the aftermath of the Eurozone crisis, countries in Southern Europe have been outperforming Germany since the beginning of the global pandemic, especially the French economy.

France has been performing particularly well. The French economy grew far faster than Germany throughout 2022 and 2023. Moreover, GDP projections show that France will continue to exceed German growth rates in the coming years.

Soft Power: Tourism and cosmetics

France has a well-known cultural appeal, especially for the more sophisticated palate. The country boasts its fair share of fine-dining experiences and high-quality wineries. Both can come with a hefty price tag.

France is also well-known for its very long coastlines along the Mediterranean and the Atlantic, its mountains and ski resorts in the Alps and Pyrenees. There are thousands of châteaux (castles) and other historic cultural sites dispersed throughout the country, including 49 World Heritage sites! Meanwhile Paris is a cultural hotspot that offers countless cultural experiences together with an excellent cuisine and luxury shopping. What’s not to like?

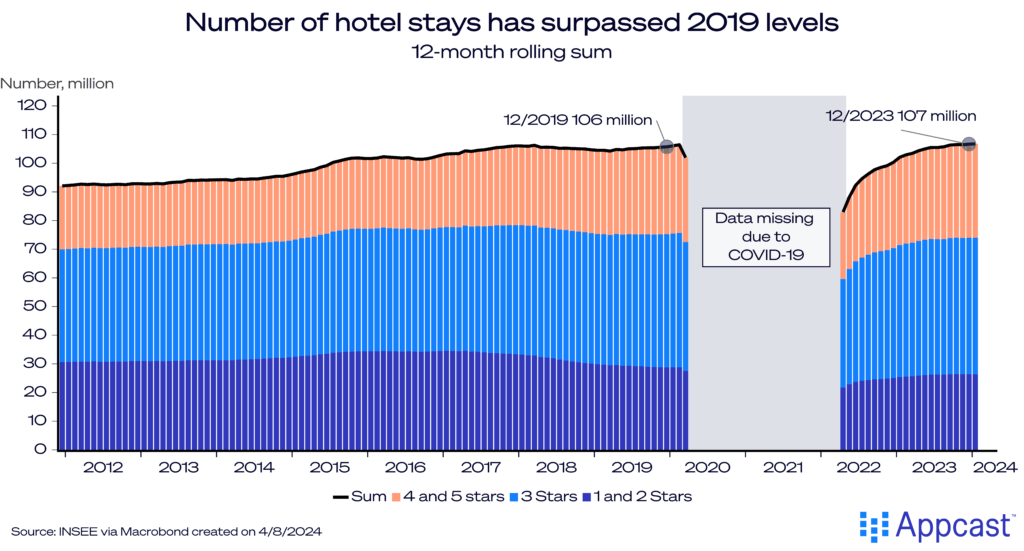

It is therefore no wonder that international tourism revenues bounced back strongly following the pandemic and reached a record of close to 60 billion euros last year, an increase of about 12% compared to 2019.

While France is slightly less dependent on tourism than most of Southern Europe, the sector nevertheless accounts for some 7.5% of GDP with several million jobs attached to it. And with the Olympics in Paris coming up this year, we should expect a spectacular 2024 for the capital.

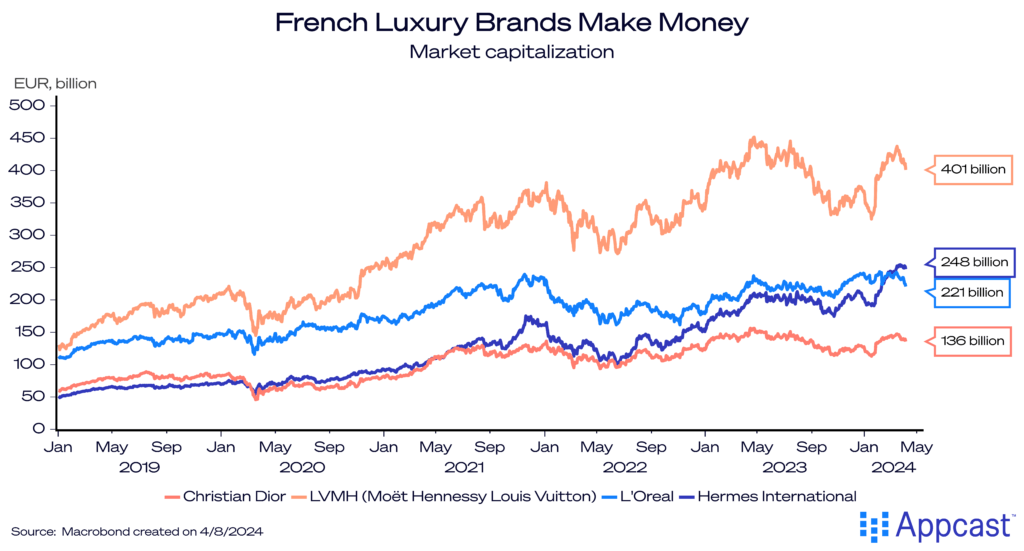

Another French money maker is its beauty and fashion industry. Not only are French luxury brands like Louis Vuitton, Dior, Hermes, and L’Oreal known worldwide, but they are now also among the most valuable companies in all of Europe, each of them boasting several hundred billion euros in market capitalization.

It is therefore fair to say that France is a global soft power thanks to its international appeal as the number one tourist destination together with its exports of luxury goods.

Hard power: weapons and shipbuilding

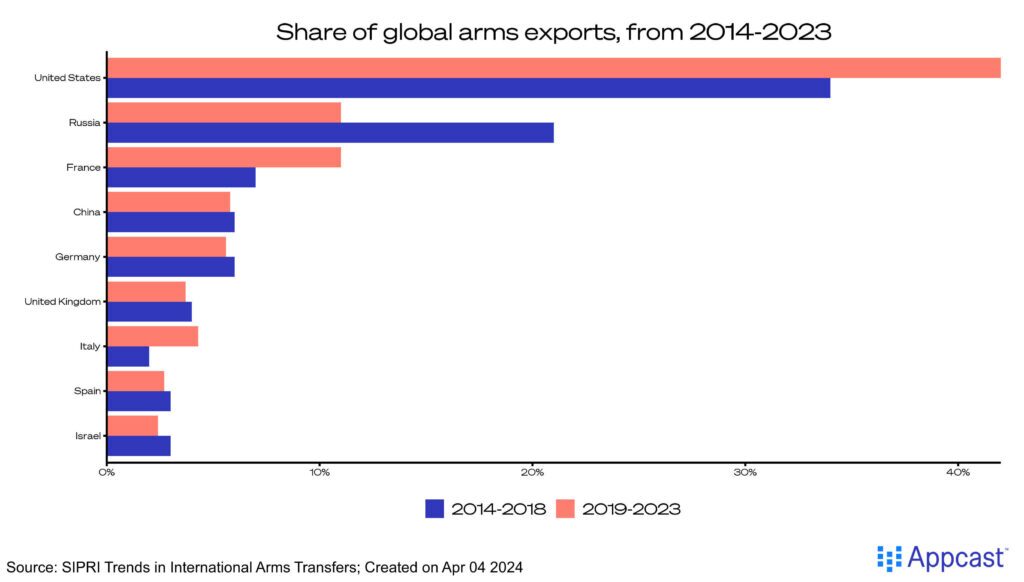

But France is not just about wine, cheese, and perfumes. More recently, the country has also benefited from the rise in international conflicts. Having always been one of the more hawkish members of NATO, France is proud to have the largest military in continental Europe together with its independent arms manufacturing industry.

The sector has been doing well since the beginning of the war in Ukraine. French industrial production of weapons and ammunition has increased substantially in recent years.

The French Navy is one of the largest in the world and France is one of only four countries that has shipbuilding capabilities for nuclear propulsion powered warships, including both submarines and aircraft carriers. The country is also a European leader in building military aircrafts: French company Dassault has been ramping up production of fighter jets as orders have surged.

With French military equipment being en vogue right now, the country has now surpassed Russia to become the second-largest arms exporter in the world.

Investment inflows

But France is more than just a pretty face, beautiful beaches, and severe weaponry. France has also received an increasing amount of foreign direct investment (FDI). More and more international companies are channeling money into the French economy from abroad.

According to research from Santander, about 18% of the FDI came from the U.S. Manufacturing and finance and real estate are the two largest main sectors receiving more than 29% and 25% of all inflows, respectively.

FDI inflows into France have been on an upward trend and increased by more than 50% relative to 2017. Meanwhile Germany has received less foreign investment since the start of the pandemic.

Cheap energy, a competent civil service, and more favorable demographics

There are several other factors that have helped support the French economy in recent years. First, France has cheap energy compared to other European nations. Thanks to its large fleet of nuclear reactors, the country is producing roughly 70% of electricity from nuclear energy. As a result, French households have been enjoying cheap electricity prices for many years and have been more shielded from the massive surge in prices that occurred recently.

Second, as Tyler Cowen recently argued, French state capacity is very high. Many French civil servants in the higher ranks have been trained in the country’s Grandes écoles, elite universities, but have historically suffered from getting in their own way. Cowen argues that bureaucracy that was once a hindrance might now turn out to be a comparative advantage. It currently feels like the world is sliding from one international crisis to the next. State capacity and capable bureaucrats will become even more important during a time when many other countries struggle with governance.

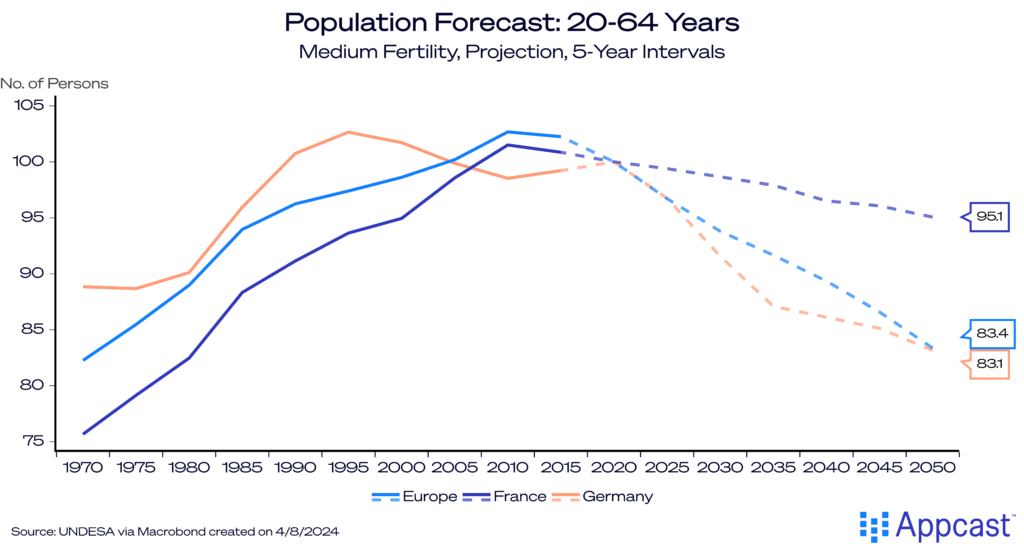

Last but not least, France also has slightly more favorable demographics compared to other European countries. Germany and parts of Southern Europe (like Italy and Spain) will soon experience a shrinking workforce. These countries are particularly affected by an aging society. France, on the other hand, has had much higher fertility rates in recent decades, meaning that the French population pyramid is healthier, and the country’s workforce is expected to decline by much less.

What does that mean for the labor market?

The French economy has been doing rather well recently, and not just because of tourism and luxury goods. With international conflicts on the rise, French arms manufacturers are also getting a boost. Moreover, France has become a more attractive economy to invest in relative to other European economies, Germany in particular. Cheaper energy, a competent civil service, and slightly more favorable demographics than many other European economies are helping.

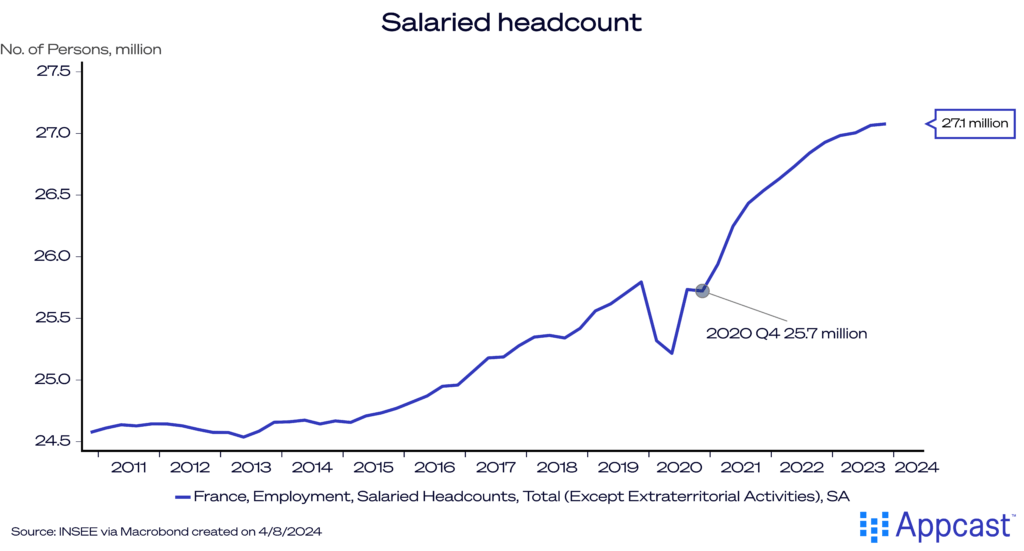

The labor market added more than 1.4 million salaried employed since early 2021. This employment gain that occurred within just three years is slightly exceeding the total number of jobs added in the nine years between 2011 and 2020.

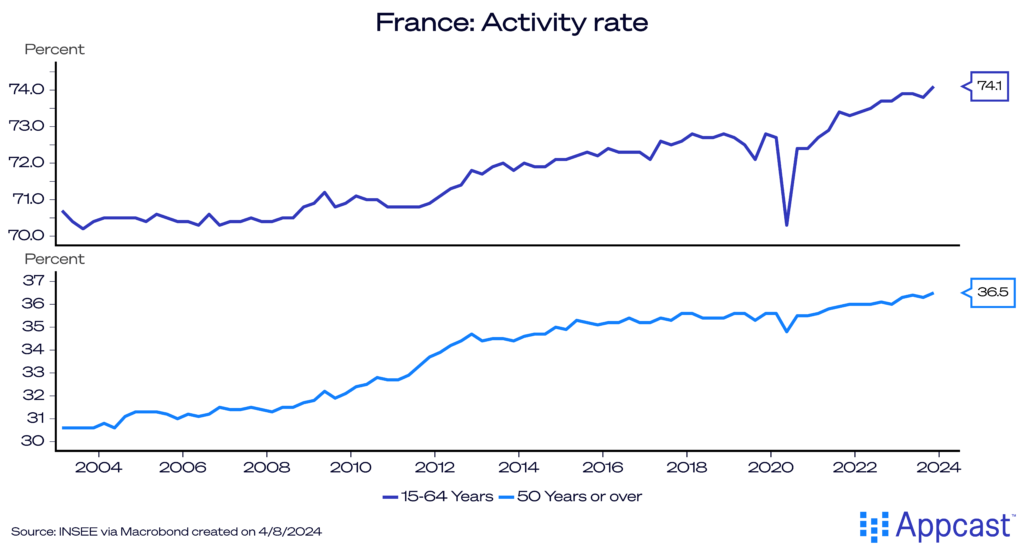

As I mentioned in a previous piece, unlike in Germany, most of the job creation in France has occurred in the private sector. The French unemployment rate is at a historic low. The activity rate of the prime-age population (15 to 64 years old) has increased by about 1.5 percentage points while the activity rate for older workers (50 years and above) increased by one percentage point since 2020.

What does that mean for recruiters?

It is fair to say that the French labor market is currently hotter than it has been in a long time. And while French demographics are better than those of many other European nations, the workforce is still aging. That aging workforce will mean that future employment growth might slow down if immigration cannot make up for the deficit.

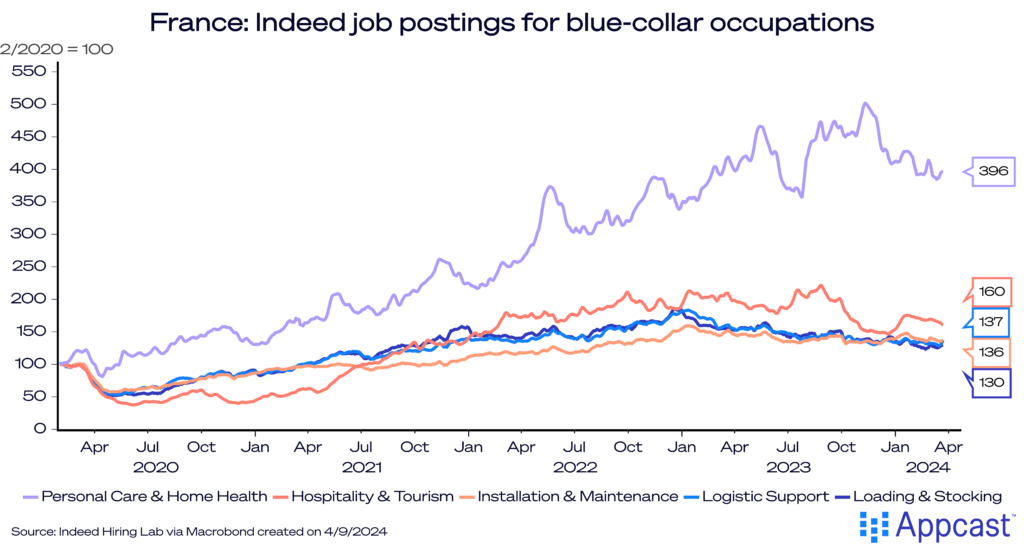

Similar to other advanced economies, job postings for “standing-up jobs” (blue-collar) remain elevated compared to pre-pandemic levels.

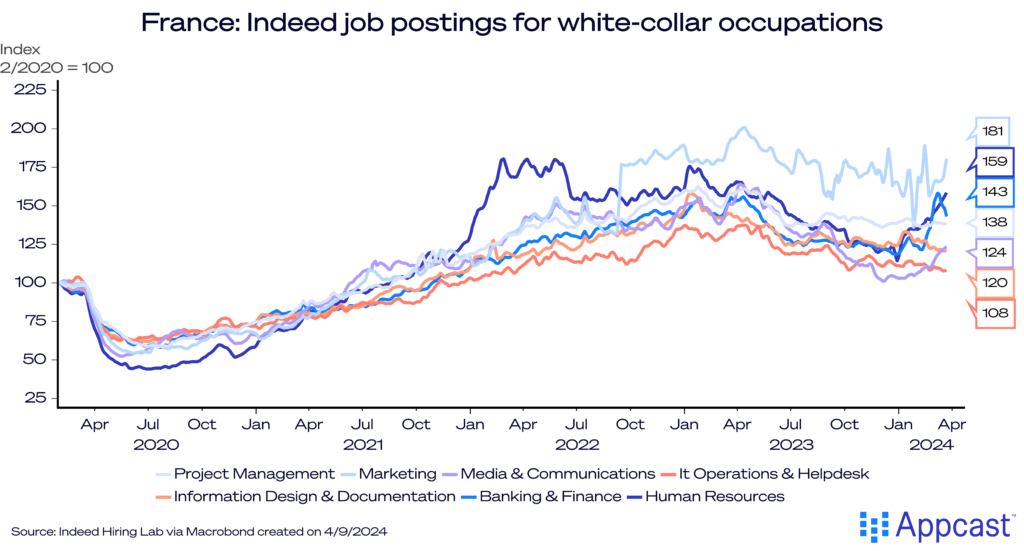

However, unlike other advanced economies that are currently experiencing a white-collar recession, France has not seen a similar decline in job postings for such “sitting-down jobs” yet.

For the time being, recruiters will continue to face some challenges hiring in France, which is enjoying the tightest labor market in decades. Job postings across different occupations and labor market segments remain elevated for now and the country has escaped the white-collar slowdown that many other markets are currently experiencing. This means that competition for workers will remain high across industries.