Inflation remains elevated. Bank failures still spook investors. Layoffs – limited to tech giants, so far – cast a wide shadow. Economic uncertainty is high. Whether or not the U.S. economy will enter into a recession hangs in the balance.

Against this economic backdrop, politics is pushing the U.S. to the brink. The latest debt ceiling brinkmanship is just the latest – and most dangerous – example of a toxic polarization doom loop spilling over into the economy.

Before touching on how the debt ceiling drama could affect the economy, and specifically the labor market, it’s worth taking a look at one of the worst ways divisive political fights are hurting our understanding of the U.S. economy.

Polarization makes economic indicators less useful

One cannot fix what one does not understand. Unfortunately, decades of rising political polarization is clouding our understanding of the economy. Democrats tend to rate the economy as worse than it really is under a Republican president and vice versa with Republicans under a Democratic president, as is the case now.

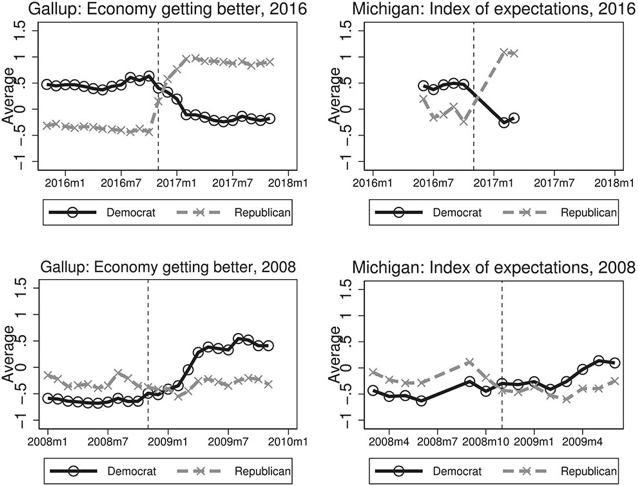

Academic research just published this month by Atif Mian, Amir Sufi, and Nasim Khoshkhou took this a step further. They linked this well-known partisan bias on views of the economy to surveys of economic expectations that are often used by forecasters to predict a recession. The chart below shows surveys from Gallup and the University of Michigan about economic expectations before and after January 2017, when President Donald Trump took office. Not much about the economy changed over one month. But partisan opinion flipped.

Now, you can chuckle at this and move on. But what Mian et al. found is that this polarization of economic attitudes is growing over time to such a degree that it distorts surveys like the University of Michigan Consumer Sentiment Index. These surveys are key inputs to leading economic indicators often used by forecasters to pinpoint when a recession may be coming.

The fact that, say, 50% of Americans think the economy is in a recession used to be insightful when individual economic views were less correlated to who has political power – but not now. The high and rising level of partisan bias in the U.S. is corrupting our economic signals – the lighthouses that guide forecasters through foggy uncertainty.

A debt ceiling breach is unlikely but not unthinkable – and definitely catastrophic

This brings us to the current precipice with the debt ceiling. A quick primer: The U.S. has a strange two-step process where Congress both authorizes spending and (when necessary) raises the limit on the nation’s debt. Congressional Republicans are demanding spending cuts in exchange for raising the debt ceiling, while President Biden and Democrats want a “clean” increase. The U.S. Treasury Department has signaled that as early as June 1 it will hit the so-called “X-date,” where effectively it will run out of money to pay its bills. So time is ticking as negotiators haggle over the federal budget.

Most economists and political pundits expect that a debt ceiling deal will be cut at the 11th hour, just before default looms. History affirms this, such as when President Obama and Republicans wrapped up near-death debt ceiling negotiations in 2011. Michael Feroli, the chief economist at J.P. Morgan Chase, summarized this view in a note on May 24: “We still think the most likely outcome is a deal signed into law before the X-date, though we see the odds of passing that date without an increase in the ceiling at around 25% and rising.”

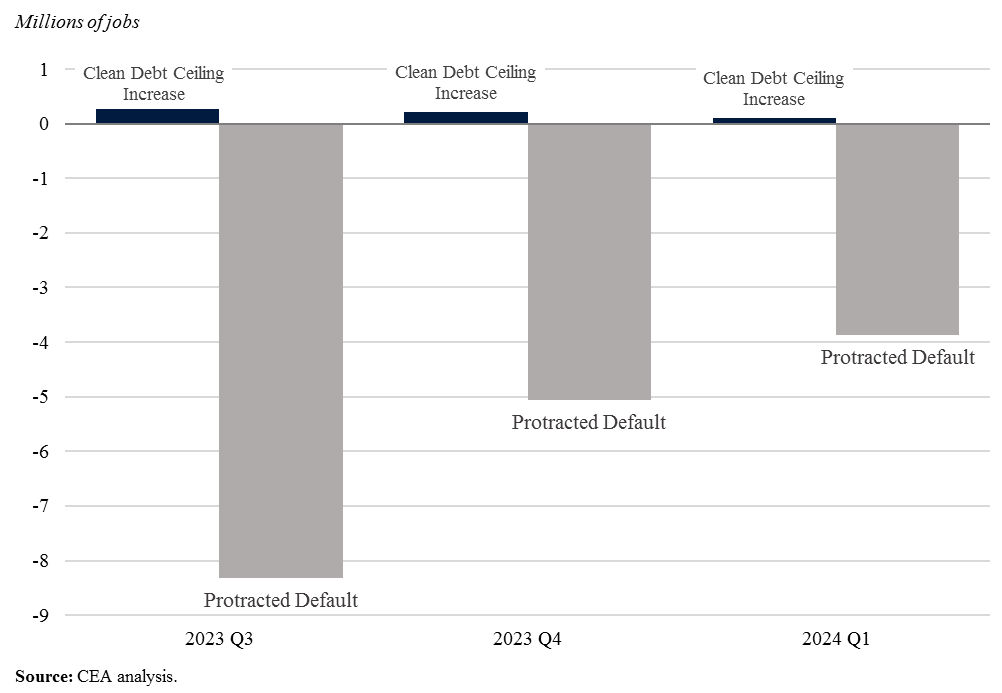

In the worst-case scenario – a protracted default – the Council of Economic Advisors estimates a grim scenario, as detailed by the graphic below. Here are the gory details:

“In 2023 Q3, the first full quarter of the simulated debt ceiling breach, the stock market plummets 45 percent, leading to a hit to retirement accounts; meanwhile, consumer and business confidence take substantial hits, leading to a pullback in consumption and investment. Unemployment increases 5 percentage points as consumers cut consumption and businesses lay off workers.”

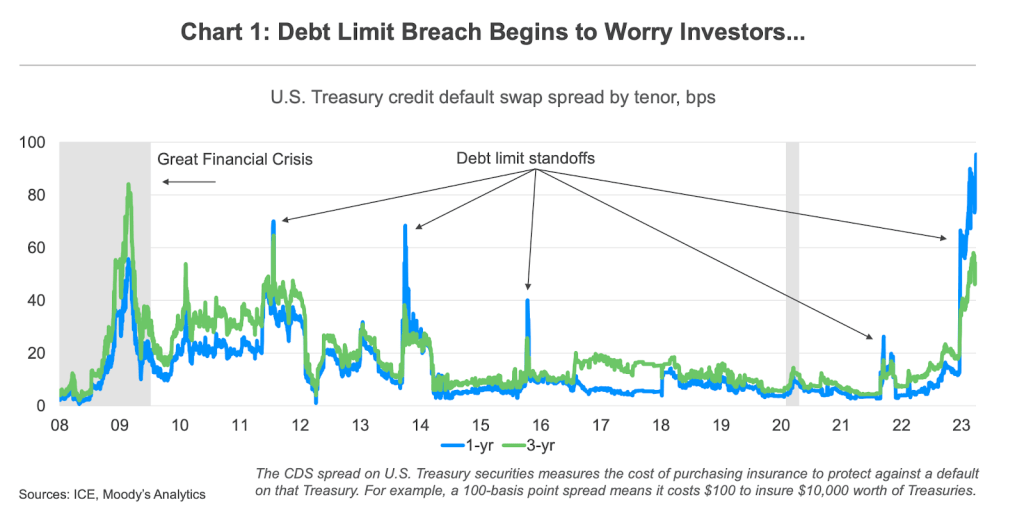

As Moody’s Analytics has analyzed in detail, the mere threat of a debt limit breach is spooking investors. The chart below shows rising credit default swap spreads for U.S. Treasury bonds – effectively, the cost of insuring against a debt default. As investors begin to hedge their risk of the unthinkable (default), rising credit costs can spill over into wider financial market turbulence.

Conclusion

Currently, the labor market remains strong. But the longer debt ceiling brinkmanship lingers, the more financial markets could react negatively. That strain on financial markets could deal a painful blow to the labor market. Withstanding inflation is one thing, but inflation paired with financial instability? The strong labor market would suffer. And this drama is just one example of how political polarization is hurting the U.S. economy (or economists’ ability to understand it). The consistent politicized shifting of the economic goalposts will only cause further uncertainty in the years to come. When a lighthouse dims, or extinguishes completely, a boat can easily miss the warning sign and sail directly into a cliff.