Inflation and wages have surprised to the upside

The United Kingdom is the only G7 economy that still has a slightly lower GDP compared to the end of 2019. It is also the one country where inflation has proved particularly sticky and is currently still exceeding 10%. This “stagflationary” outcome – low growth combined with high inflation – is, to some extent, related to Brexit. Leaving the common market increased trade costs and led to depreciation of the British Pound, which has been feeding into higher domestic prices. Moreover, the U.K. labor market is currently quite tight, and Brexit has led to labor shortages across multiple industries, such as transportation and food and hospitality. Last but not least, wage growth has recently accelerated and has been exceeding expectations. While this is good news for workers, it is definitely bad news for the Bank of England (BoE), as the current level of wage growth is inconsistent with the BoE’s inflation target (2%).

This has renewed fears at the BoE that the U.K. economy might fall into a wage-price spiral – a situation in which high wage growth fuels inflation, which feeds back into even higher wage growth, and so forth.

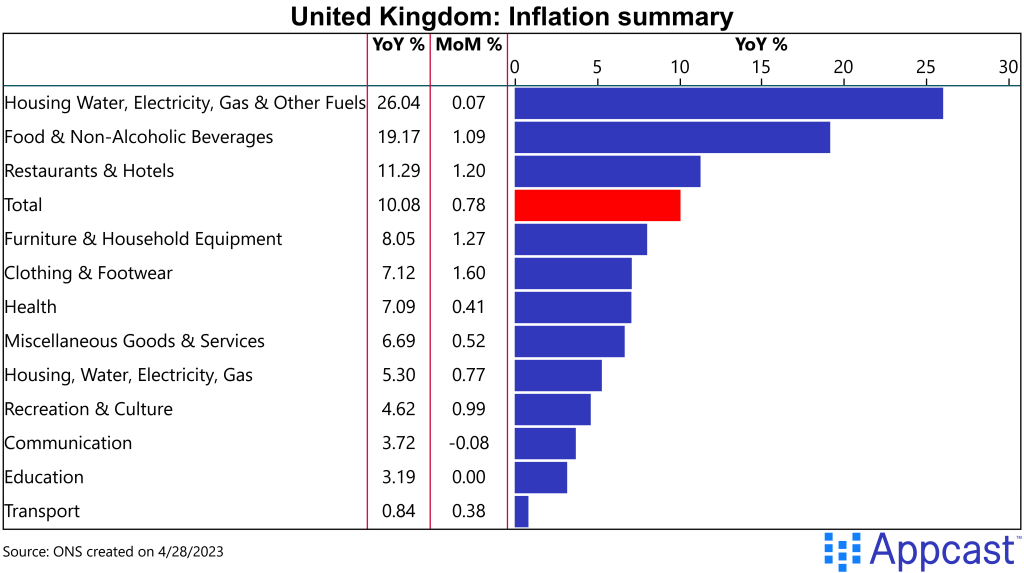

The chart below displays inflation rates by subcategories. The overall inflation rate came in slightly above 10% in March. Food and beverage prices are some 20% higher than a year ago and water, electricity, and gas prices are more than 25% higher.

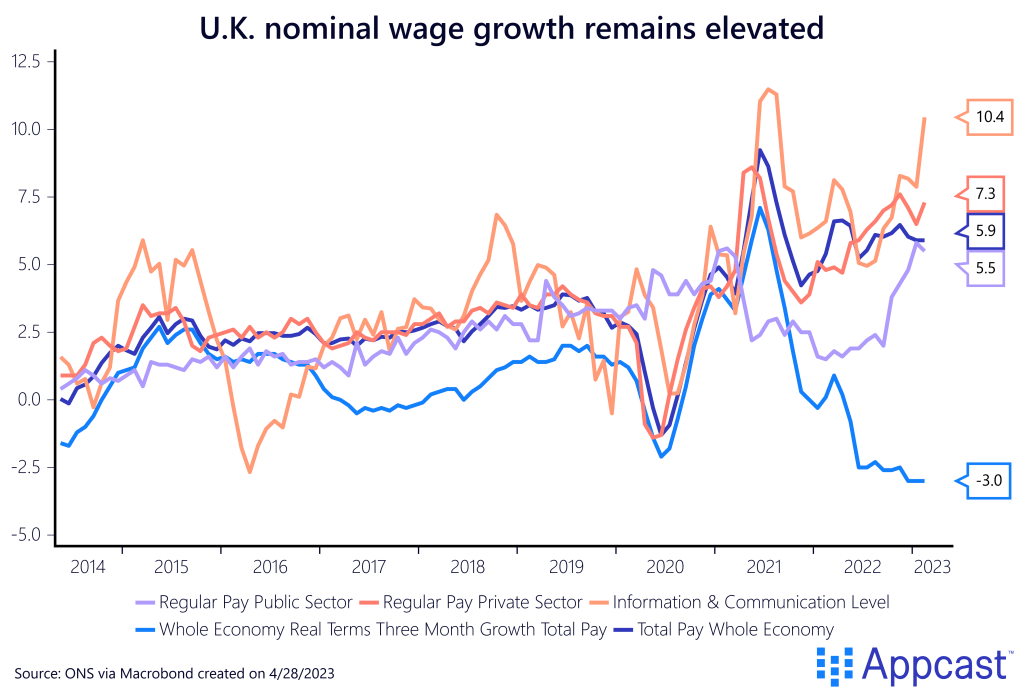

Wage growth in the U.K. has also accelerated during the pandemic. Labor shortages in some sectors and a generally tight labor market have increased workers’ bargaining power. While wages are generally lagging behind prices now, nominal wage growth is surprisingly strong, at about 7% for the private sector and about 5% for the public sector. And – despite the recent turmoil from layoffs at large global tech companies – wage growth in IT is still running above 10%.

Inflation and wage growth expectations remain too high for the BoE’s liking

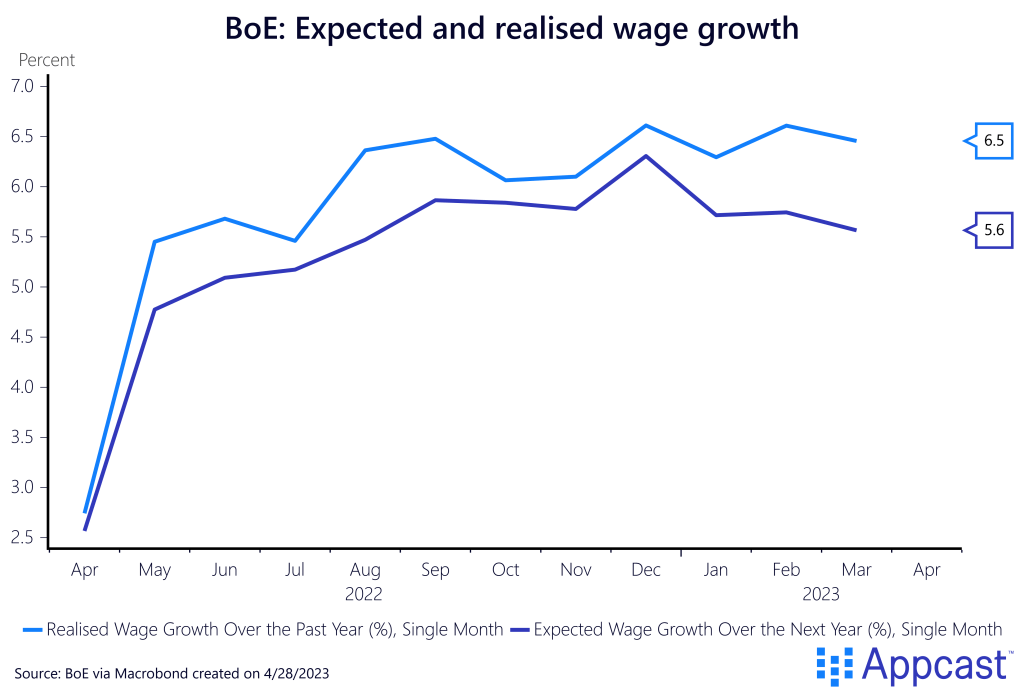

More importantly, and more worryingly from the BoE’s perspective, wage growth expectations for the year ahead are currently running at about 5.6%. But realized wage growth has been even higher than expected wage growth over the year. Assuming 2% productivity growth going forward – a very optimistic assumption, by the way – nominal wage growth needs to be closer to 4% to be consistent with a 2% inflation rate. So, these numbers are far too high and inconsistent with the BoE’s inflation target.

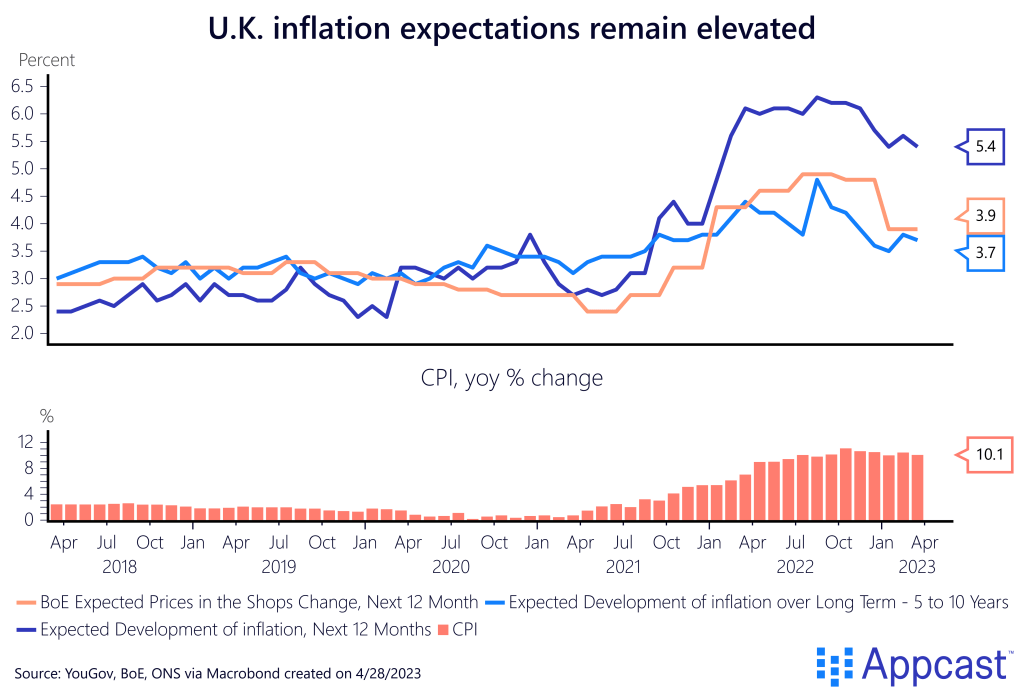

Wages are the most important input cost for many businesses, especially in the service sector. Therefore, it’s no surprise that inflation expectations for the year ahead are extremely elevated. With higher wage growth, inflation will remain high and sticky in the food and hospitality sector.

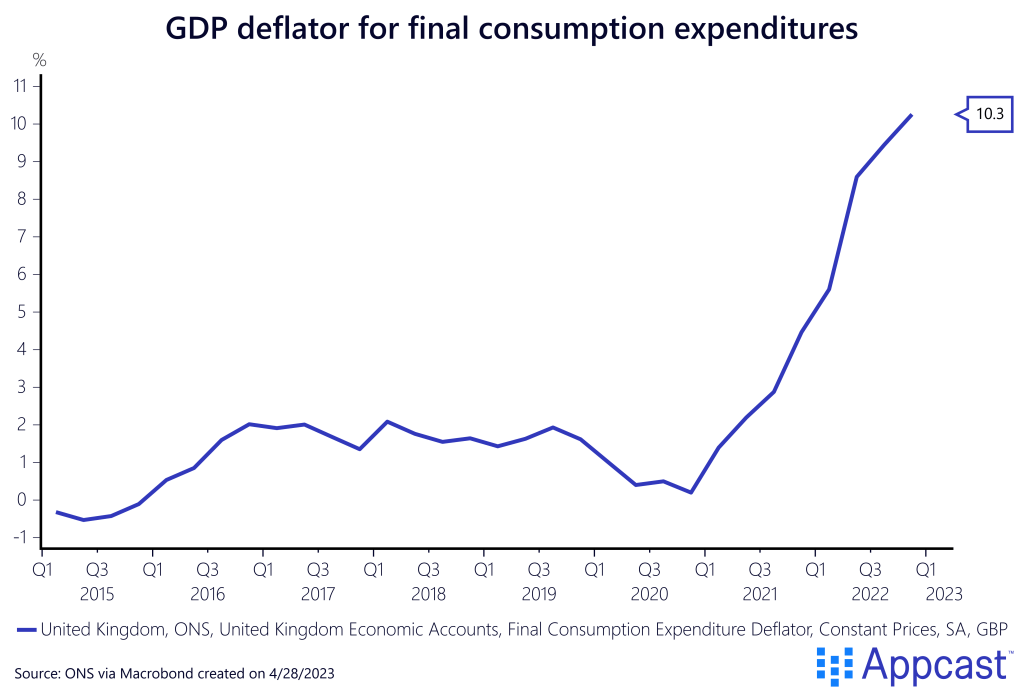

The price index (GDP deflator) for all final consumption expenditures in the economy shows an increase of more than 10% as of late 2022, while running at about 2% during the pre-pandemic period.

While a big part of the increase is due to higher energy and input prices, it is becoming increasingly clear that this is only part of the story as the U.K. economy is actually holding up much better than previously expected.

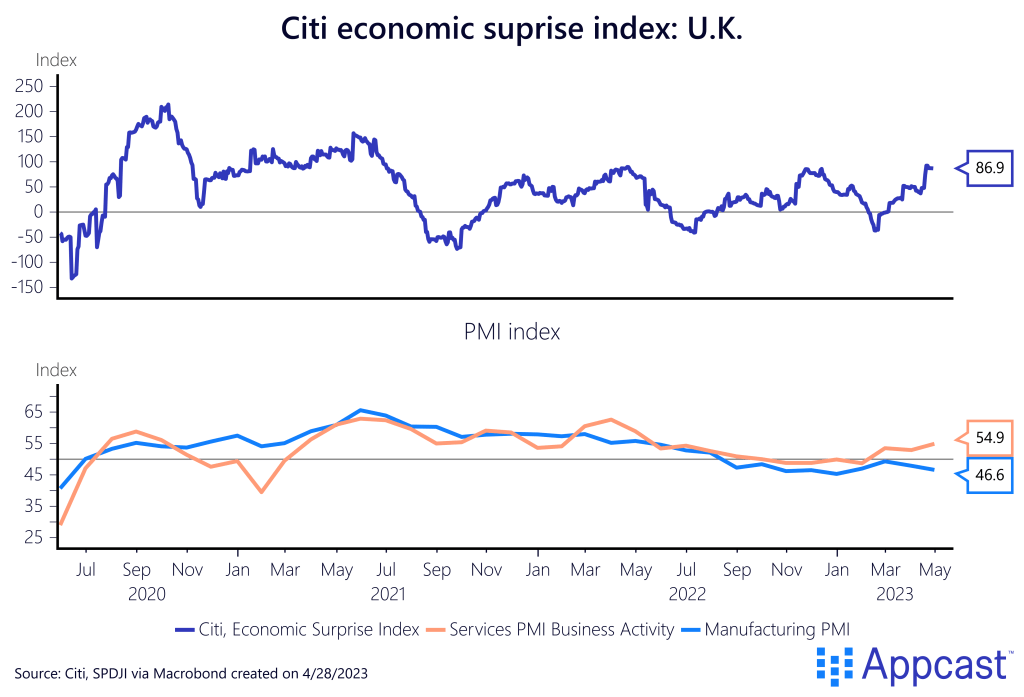

As we argued a few months ago, the BoE’s forecast of a deep recession in 2023 was always somewhat unlikely but a downturn is probably baked in. Now, it increasingly looks like the U.K. economy will avoid a recession altogether.

As the Citi economic surprise index shows, U.K. economic data has been surprisingly positive over the last few months (a positive reading means that data releases have come in better than expected). While the Purchasing Managers Index (PMI) still suggests a contraction for manufacturing, the services PMI has recently increased to well-above 50 and now stands at almost 55, meaning that the service sector is well into expansion territory.

While the month of May will have three public holidays, the coronation of King Charles on the 7th of May will probably boost spending even more. According to a recent Bloomberg report, pubs and restaurants are expected to see additional consumption of about 350 million pounds on that long weekend, and a lot of the additional spending is coming from tourists. Americans alone will account for more than 30% of bookings in 4 and 5 star hotels, significantly more than usual for this time of year.

Given the relatively upbeat outlook and the strong inflation and wage dynamics that are coming in higher than expected, it should be no surprise to anyone that the BoE is not quite done hiking yet, even as the interest rate already stands at 4.25%.

While the peak policy rate that financial markets expect in the U.K. plunged during the month of March, when global financial markets were rattled by U.S. bank failures, it is now back just below 5%. Financial markets have priced in another three rate hikes of 25 basis points each this year. If wages and prices continue to come in above expectations in the coming months, then the BoE will have to hike even more.

Conclusion:

Almost all advanced economies are now seeing lower inflation after the massive inflationary surge from last year. Things are slightly different for the U.K. economy, which is edging toward a wage-price spiral. Inflation remains sticky at above 10%. Moreover, wage growth is also very strong and wage growth expectations remain far too elevated for the BoE’s liking and inconsistent with its 2% inflation target. It is no surprise that the BoE is not done with its rate hike cycle yet and that financial markets have priced in a higher rate. The longer prices and wage inflation remains elevated, the harder it will be for the BoE to bring expectations of both workers and businesses down again. Let’s hope for some disinflation in the coming months, or the BoE might feel enticed to hike the economy into a recession to bring wage and price growth back to target.