Inflation may be turning a corner but there are still threats that could run it off the road.

Some of them are out of anyone’s control, like a disruptive avian flu. Others, like services inflation buoyed by strong wage growth, are the top priority of the Federal Reserve. But most threats are still unknown – waiting silently in the wings to take center stage.

Out of everyone’s control

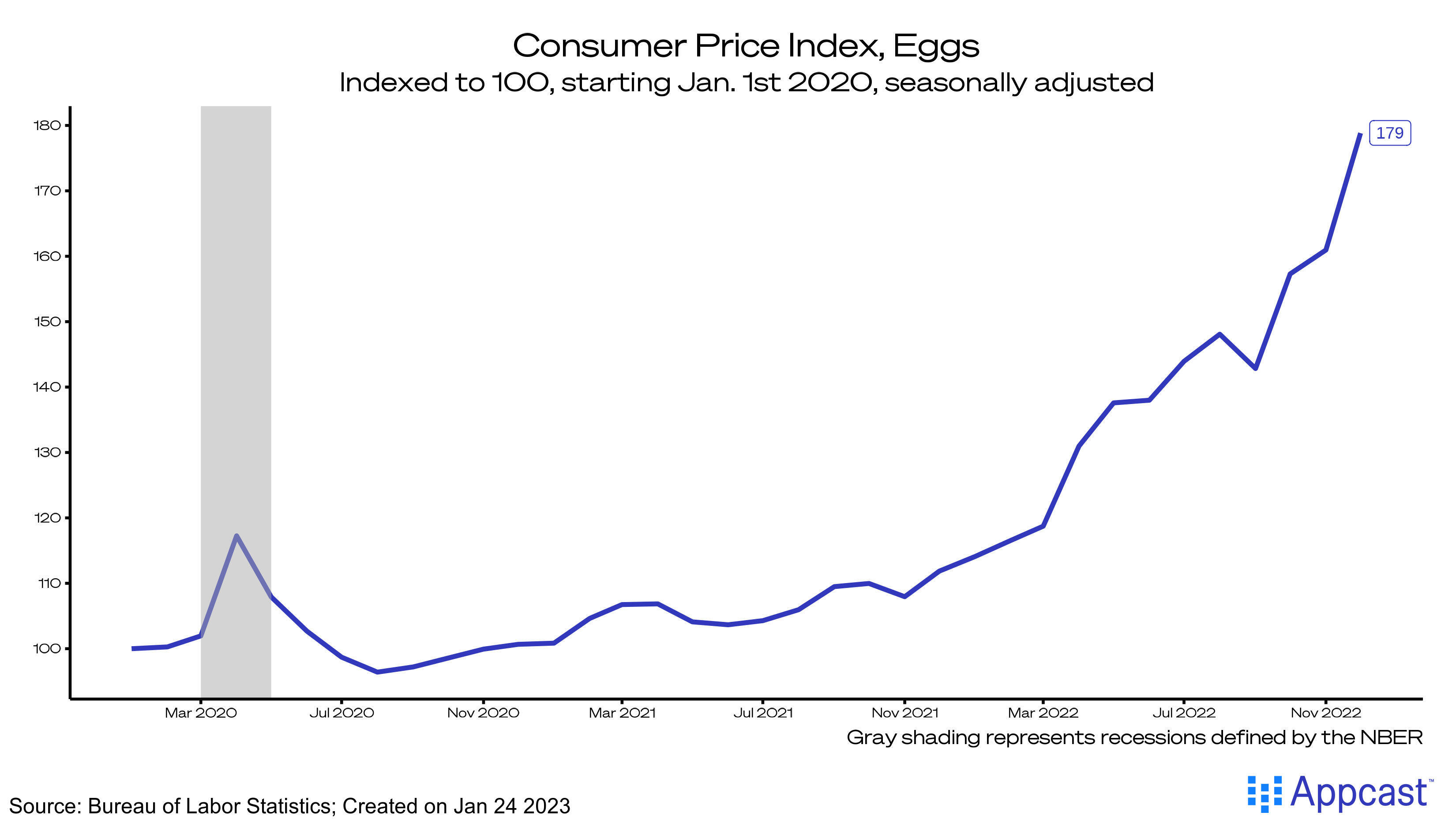

If you’ve walked into a grocery store in the past month, you’ve probably noticed the skyrocketing cost of eggs. Prices for this kitchen staple (especially in the winter baking season) were up 60% in December from the year before. Needless to say, people have been flipping out.

Egg prices have been on the rise primarily because of a poorly timed and deadly bout of avian flu. Since February, this flu (and the measures of depopulation meant to cull the disease) has killed over 52 million chickens and turkeys (you might have noticed a more expensive Thanksgiving, too). The supply of eggs in the country was absolutely scrambled by a naturally spreading disease far out of the control of egg farmers, much less the Federal Reserve.

Central bank priorities

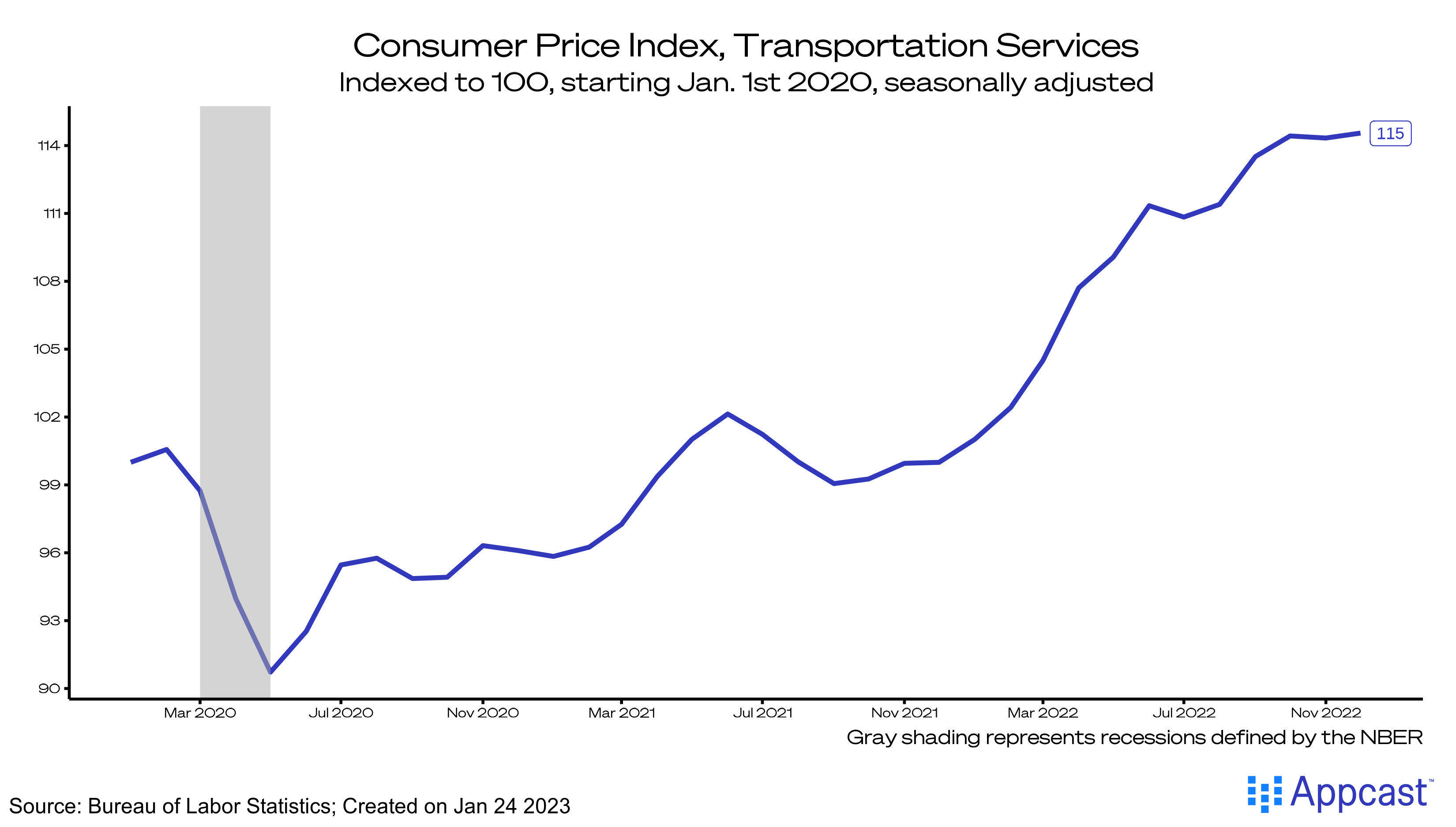

Other threats are a bit easier to crack – or at least should be. Though goods prices were the first to accelerate, costs of services were not far behind. Now, services are driving the continued inflation – and the fear is that high wages could beget higher prices, or vice versa. Fed officials are still looking out for the threat of the dreaded wage-price spiral, which helped entrench inflation into the economy back in the 1970s. Because of the tight labor market, wage growth has been robust, though it has moderated in recent months.

The Fed will be watching for a reverse in that moderation. If wages continue to grow at unsustainable rates, the transportation services CPI below (whose current path suggests a peak) could continue to grow.

The Unknown

Beyond these out of control and known risks, there’s also any number of risks that could disrupt the current path of inflation. For instance, the loosening of China’s zero-COVID policy will rejuvenate the country’s economy but could also add to demand-side inflationary pressures. A development in Ukraine could send gas prices soaring again. A major weather event could complicate supply chains.

Currently, the inflationary outlook is positive: core goods are cooling, housing seems to be on the brink of moderation, and, so far, expectations remain anchored. But in a time of heightened economic and geopolitical anxiety, it’s not all sunny-side up – there are certainly still some risks.