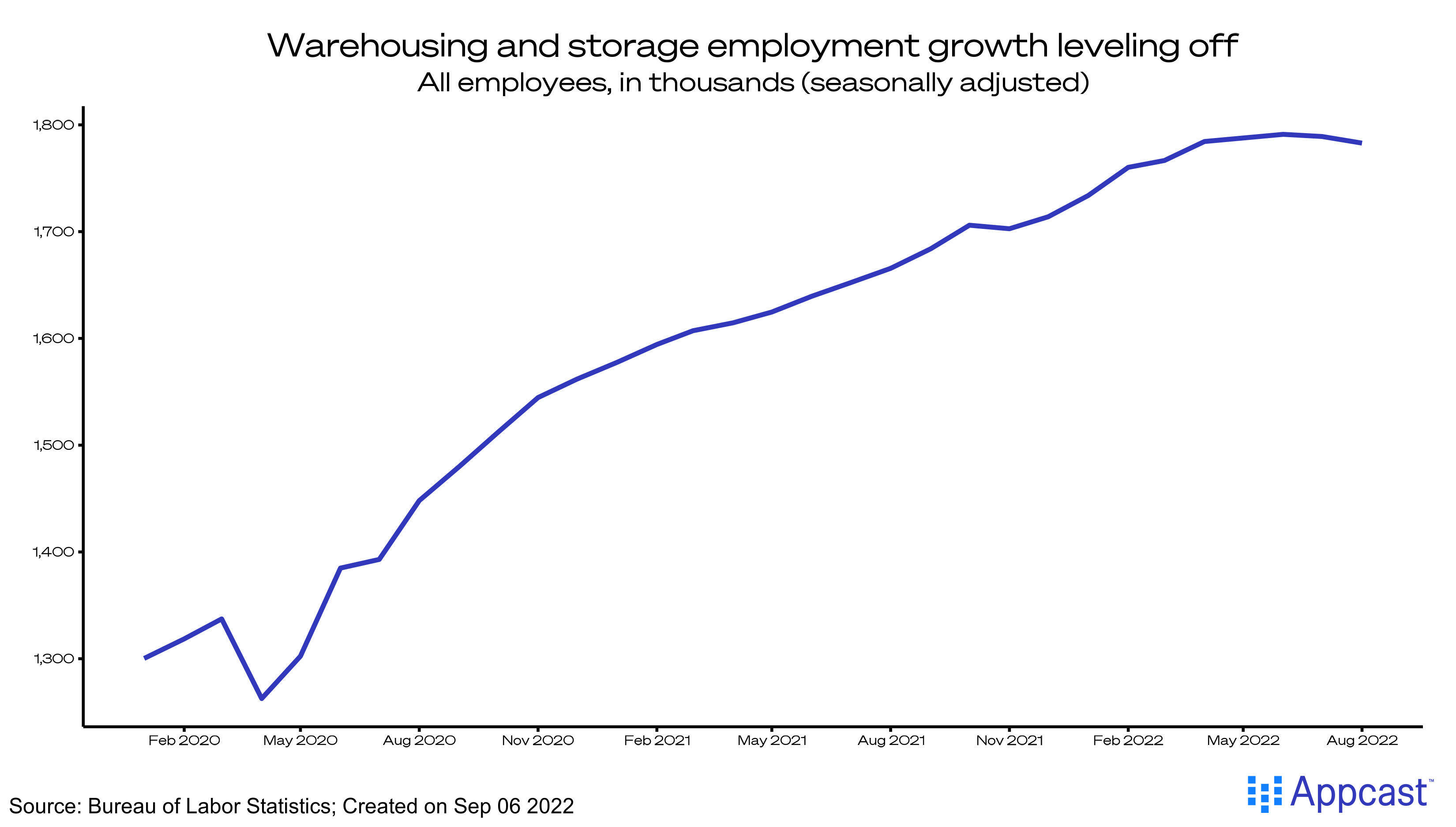

Warehousing jobs boomed during the COVID-19 recession recovery. Nationwide quarantine turned out to be the perfect environment for warehousing and storage employment to thrive in. Increased consumer demand for goods prompted companies to ramp up hiring, and a massive jump in unemployment expanded the pool of labor to pull from. It took just three months for the sector to recover the initial loss of workers and for over two years now it has grown steadily.

However, the sun could be setting on the sector’s robust run of job gains. After two years of incredible growth, warehousing employment has plateaued, flattened by months of meager and sometimes negative gains. Employment levels in warehousing and storage could not rise forever but the reasons it stopped this summer are hard to disentangle from one another.

The conditions that allowed for impressive gains are changing. Consumers are spending more on dining out and flights, while removing gaming consoles and workout equipment from their carts. In other words, demand is shifting from goods to services. Declining demand for labor in the warehousing and storage sector could be a natural response to this reversal.

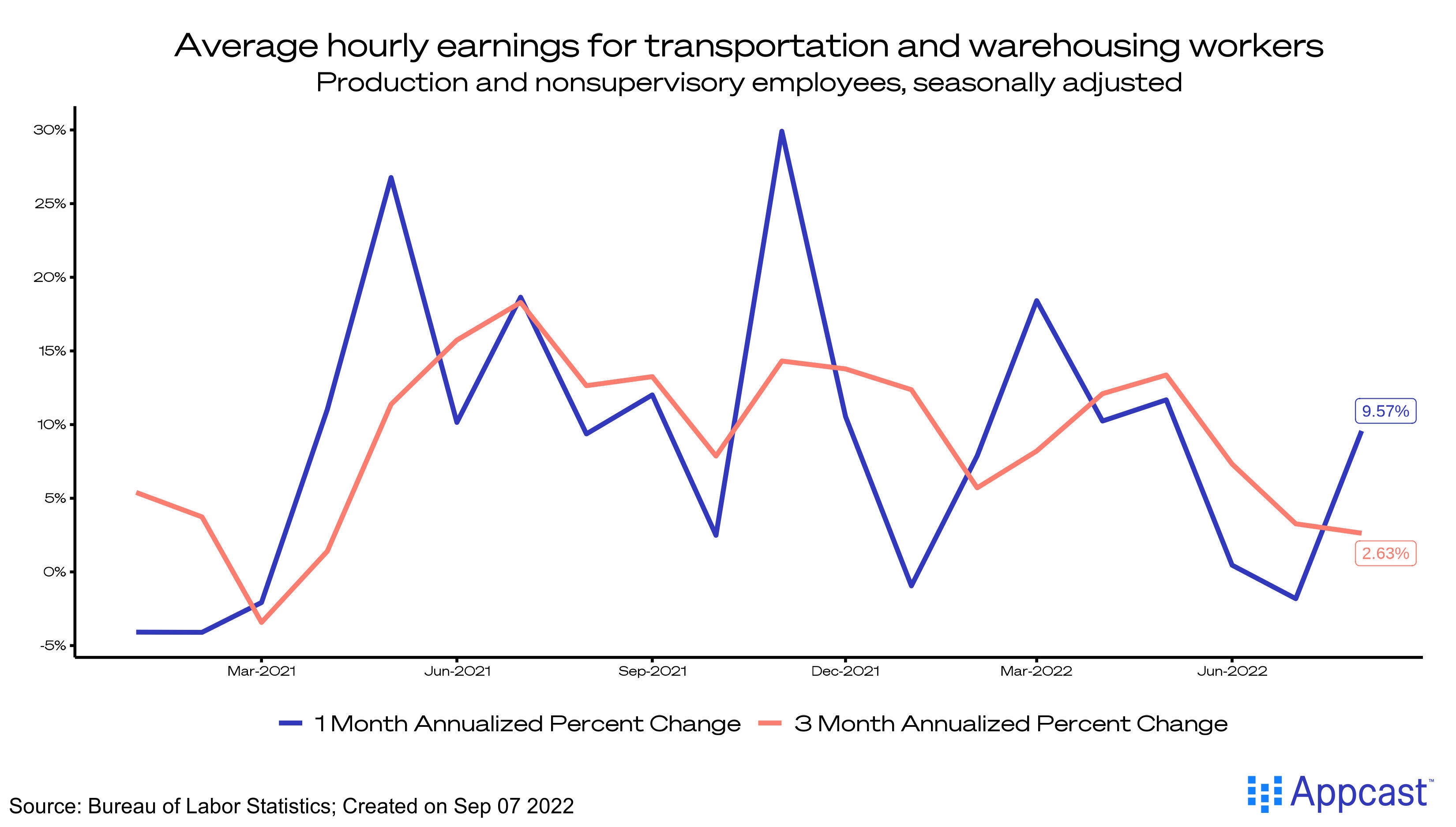

It could also be that companies were too eager in their pandemic hiring sprees and now employ too many workers. Excess workers paired with shifting demand is a vulnerable position to be in, especially considering elevated labor costs.

Amazon WFS, the leading employer in this sector, doubled their workforce in just two years. Over that same period, the median wage for warehouse workers jumped from $22.67 to $26.36. Wages were up 9.57% (annualized rate) in August, while employment fell by 6,200. Overstaffing was a side effect of the pandemic-driven hiring spree. From this point of view, warehousing jobs have plateaued because employers hired too many workers during the pandemic recovery and now must cut back in response to shifting demand and rising costs.

Is this a case of overly robust job growth leading to stalled gains or a natural response to shifting economic conditions? It’s difficult to separate the two, as the distinct forces are likely working in tandem to decrease labor demand throughout the sector. Whichever reason, it is clear that the post-pandemic warehousing boom is leveling off.