On Tuesday, December 16, the outcome of a major labor market stress test will be revealed with the long-delayed release of October and November employment data, much of which overlaps with the federal government shutdown. While the headline jobs numbers have been on hold, other indicators have trickled in, offering a clearer picture of where the labor market stands heading into year-end.

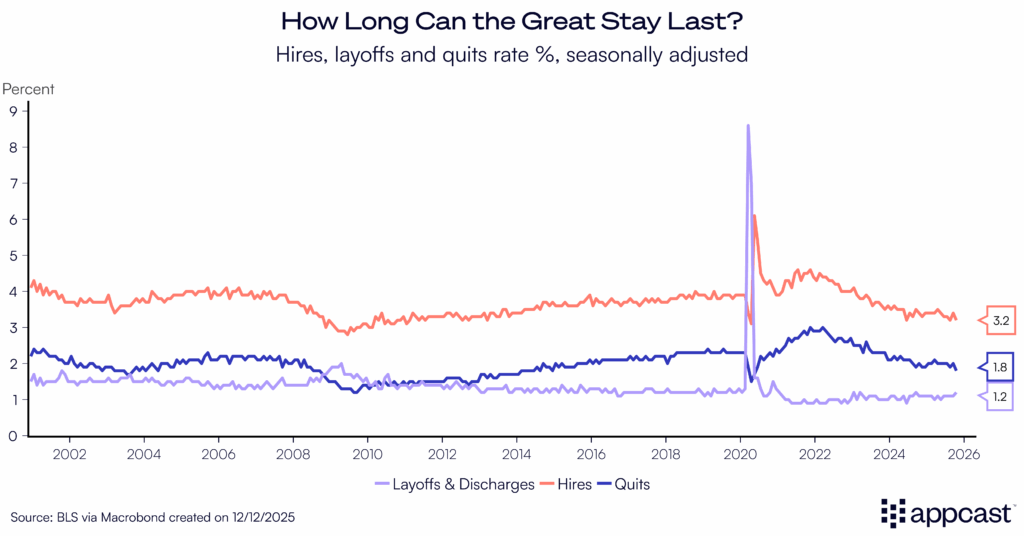

Those indicators have been pointing in the same direction for some time. The latest Job Openings and Labor Turnover Summary (JOLTS) report for October reinforced a trend that has been building throughout 2024 and 2025: hiring remains low, quits continue to drift downward, and layoffs have begun to modestly edge higher. Together, these forces describe a labor market that is no longer tight, but also not yet in free fall. This environment has been dubbed the “Great Stay,” a period defined by limited job switching and subdued hiring.

The central question heading into 2026 is how long these conditions can hold.

The delayed October and November payroll reports may ultimately reveal a labor market that is flat at best and potentially slipping into contraction. Private payroll estimates from ADP and Revelio Labs both showed job losses in November, increasing the likelihood that at least one of the upcoming BLS releases prints negative employment growth. If confirmed, that would be a meaningful shift from a labor market that has cooled gradually to one that is actively weakening.

The distinction matters because the broader economic backdrop is already fragile. Consumer sentiment remains subdued, and layoff announcements have picked up in recent months. A clear signal that job growth has stalled or turned negative could weigh on household confidence and cause businesses to pull back further on hiring plans, exacerbating the current slowdown.

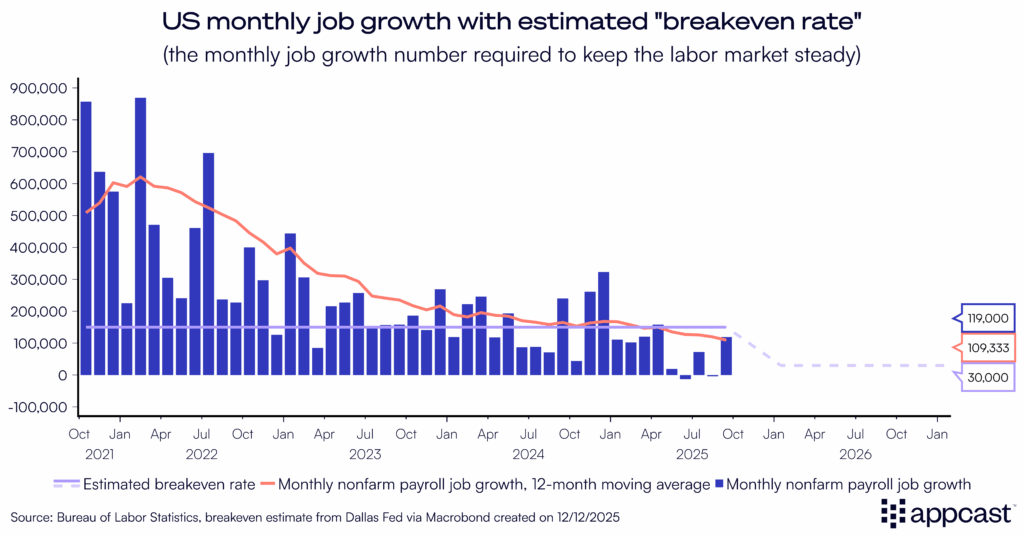

To date, much of the deceleration in non-farm payroll growth can be explained by labor supply constraints rather than sluggish demand. Tighter immigration policy has reduced the pace at which new workers are entering the labor force, mechanically lowering employment growth even as job openings remain elevated in some sectors.

But softer supply may no longer entirely explain our labor market situation. The combination of slowing hiring and rising layoffs suggests the balance may be shifting away from supply constraints and toward softer labor demand.

As a reminder heading into the release, the benchmark for what constitutes a “good” jobs report has also shifted. The relevant threshold, known as the breakeven rate, is the number of jobs that must be added each month to keep the unemployment rate from rising. As labor supply growth has slowed, that breakeven rate has fallen as well. Current estimates put it around 30,000 jobs per month, though with considerable uncertainty.

The Federal Reserve, recognizing the risks to the labor market, lowered interest rates again this week. In the words of Jerome Powell: “In this less dynamic and somewhat softer labor market, the downside risks to employment appear to have risen in recent months.”

What does this mean for recruiters?

October’s and November’s jobs data could tell us much about the future path of the labor market. If private estimates are correct, it is increasingly likely that payroll growth turned negative in at least one of those months. That outcome may reflect a short-term disruption tied to the government shutdown, or it could signal a more persistent slowdown in hiring.

As we head into the new year, the key question for recruiters is whether the “Great Stay” continues as a low-hiring, low-firing environment, or whether the risk of a broader downturn is beginning to increase.